On 20 Feb 2017 EPFO(Employees’ Provident Fund Organisation) has introduced Composite PF Claim Forms (Aadhar based and Non-Aadhar based) which replaces existing Forms No. 19, 10C, 31, 19 (UAN), 10C (UAN) and 31 (UAN). This is to simply the form for claiming the partial and full withdrawal from the EPF. This article explains the EPF New Composite Claim Forms by EPFO both Aadhar based and Non Aadhar based for partial and full withdrawal from the EPF . It talks about the differences between the Aadhar based and Non aadhar based EPF Composite claim form. It explains earlier EPF Forms for Withdrawal and Partial Withdrawal.

Table of Contents

On 20 Feb 2017 EPFO(Employees’ Provident Fund Organisation) has introduced Composite PF Claim Forms (Aadhar based and Non-Aadhar based) which replaces existing Forms No. 19, 10C, 31, 19 (UAN), 10C (UAN) and 31 (UAN). This is to simply the form for claiming the partial and full withdrawal from the EPF.

For Full Withdrawl, it has done away with two separate forms for claiming EPF(Form 19) and EPS (Form 10C). So now one form can be used which will withdraw from both EPF and EPS. We think it is a simple but excellent move.

There are two versions of the form Aadhar based form and Non-Aadhar based Forms.

Aadhar Based Full Withdrawal Forms: These forms are applicable in cases where employee’s Aadhaar Number and Bank Accounts details are available on UAN Portal and UAN has been activated. So one can withdraw by submitting these forms directly to EPFO without the attestation of the Employer. These forms were earlier called as UAN-Based Forms.

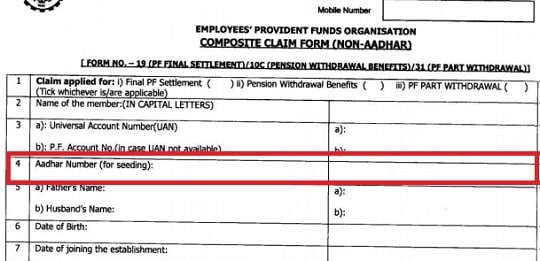

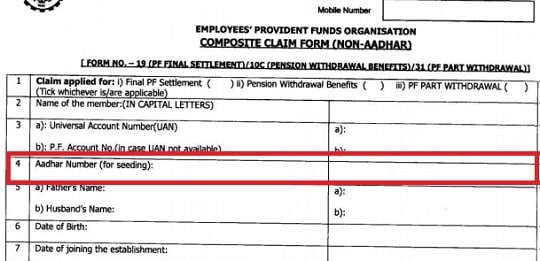

Non-Aadhar Based Full Withdrawal Forms: These forms can be used when Aadhar has not been attached with UAN. So one needs to get attestation of the employer and then employer will submit Full Withdrawal form to EPFO. But even in these forms, one need to provide the Aadhaar number as shown in the image below.

Non Aadhar based Full withdrawal composite form

New Partial Withdrawl Form: Earlier one had to submit Form 31, called as EPF Withdrawal or EPF Advance Form, through the Employer for partial withdrawal from EPF after putting in at least 5 years of service for Marriage / Education, Treatment, Purchase or construction of Dwelling house. Form31 of EPF for partial withdrawal was 3-4 pages long and required Proof and revenue stamp. EPFO has removed submission of documents and made it 1 page. So now it is just like full withdrawal form.

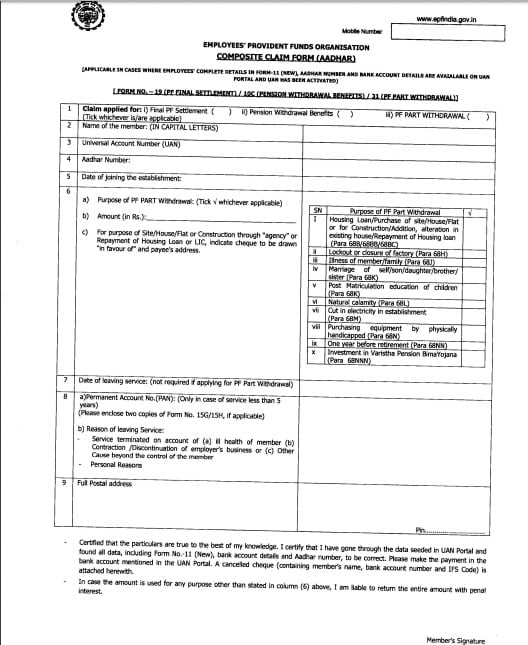

The following image shows the New New EPF Composite Claim Form Aadhar based for Withdrawal/Partial Withdrawal which requires minimal information. It requires the following information

EPF New Composite Claim Form for Full/Partial Withdrawal using Aadhar and UAN

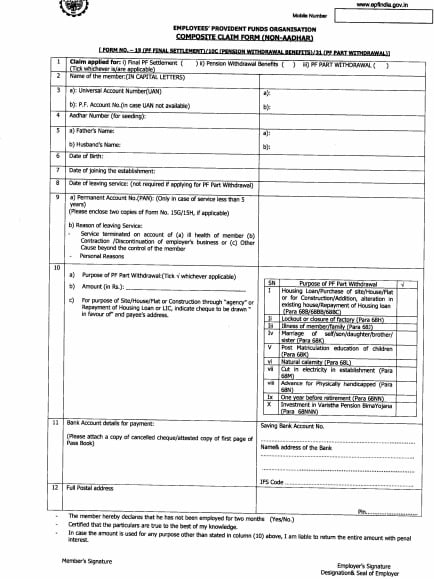

The following image shows the New New EPF Composite Claim Form Aadhar based which requires more information and the attestation from the employer. It requires the following information. Information in red is extra information than the Aadhar based form.

EPF New Composite Claim Form for Full/Partial Withdrawal without Aadhar and/or UAN

If you look at the difference between Aadhar based and Non-Aadhar based New Composite Forms by EPFO you will notice that in Non Aadhar based for more information is required.

Common Information in both the forms:

Name of the member, Date of Joining the establishment, PAN number, Full postal address, Reason of leaving service for Full Withdrawal and Purpose for Partial Withdrawal, Full postal address

Extra information required for Non Aadhar based New Composite Claim Form are as follows. One can give PF number if UAN number is not available(for those who worked before Oct 2014), Need Date of Birth, Bank Details, Father’s name, Husband’s name and Employer’s signature .

You can withdraw from EPF and EPS if you are unemployed for 2 months. You can also wait for two months to get a new job and then you can get your PF Account transferred to the new Account.

| Your Age | EPS Contribution | Form | Purpose |

| Less than 50 years | Less than 10 Years | 10C | Withdrawal/Scheme Certificate |

| Less than 50 years | More than 10 Years | 10C | Scheme Certificate(No Withdrawal benefit allowed) |

| Between 50 years to 58 years | More than 10 Years | 10C/10D | Scheme Certificate or reduced Pension |

| Between 50 years to 58 years | Less than 10 Years | 10C | Withdrawal/Scheme Certificate |

| Above 58 years | Less than 10 Years | 10C | Withdrawal |

| Above 58 years | More than 10 Years | 10D | Pension |

EPF had introduced 1-page simple UAN Based and Non-UAN Based EPF Forms which one could use to submit claim forms directly to EPFO without the attestation of employers if they had seeded/gave Aadhaar and bank account details with their UAN have the facility to by preferring claims in Forms 19 (UAN), 10C (UAN) and 31(UAN) EPF UAN based forms.

One had to submit Form 31, called as EPF Withdrawal or EPF Advance Form, through the Employer for partial withdrawal from EPF after putting in at least 5 years of service for Marriage / Education, Treatment, Purchase or construction of Dwelling house. Our article EPF Partial Withdrawal or Advance explains the process in detail.

With the EPF Partial Withdrawal Form one had to submit proof why one wants the partial withdrawal. For example for Partial withdrawal for education one needs to submit Bonafide Certificate duly indicating the fees payable from the educational institution. For Partial Withdrawal for marriage, one had to submit Marriage card. For Partial Withdrawal for Medical treatment Certificate from the doctor stating the hospitalization need. In case of any of the disease mentioned above certificate from specialist doctor..

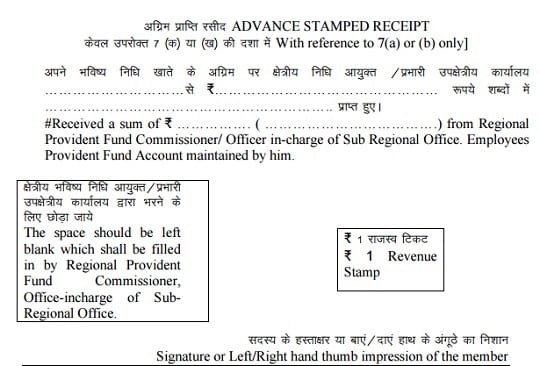

One Rupee Revenue stamp was required as shown in image below

Revenue Stamp in Form 31 for partial withdrawal from EPF

Download the EPF Forms:

You can download the new forms from here:

Related Articles: