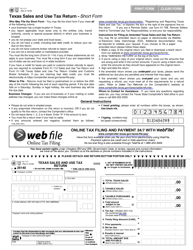

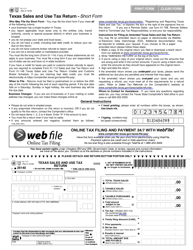

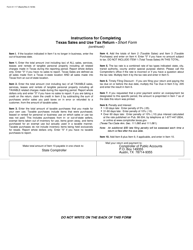

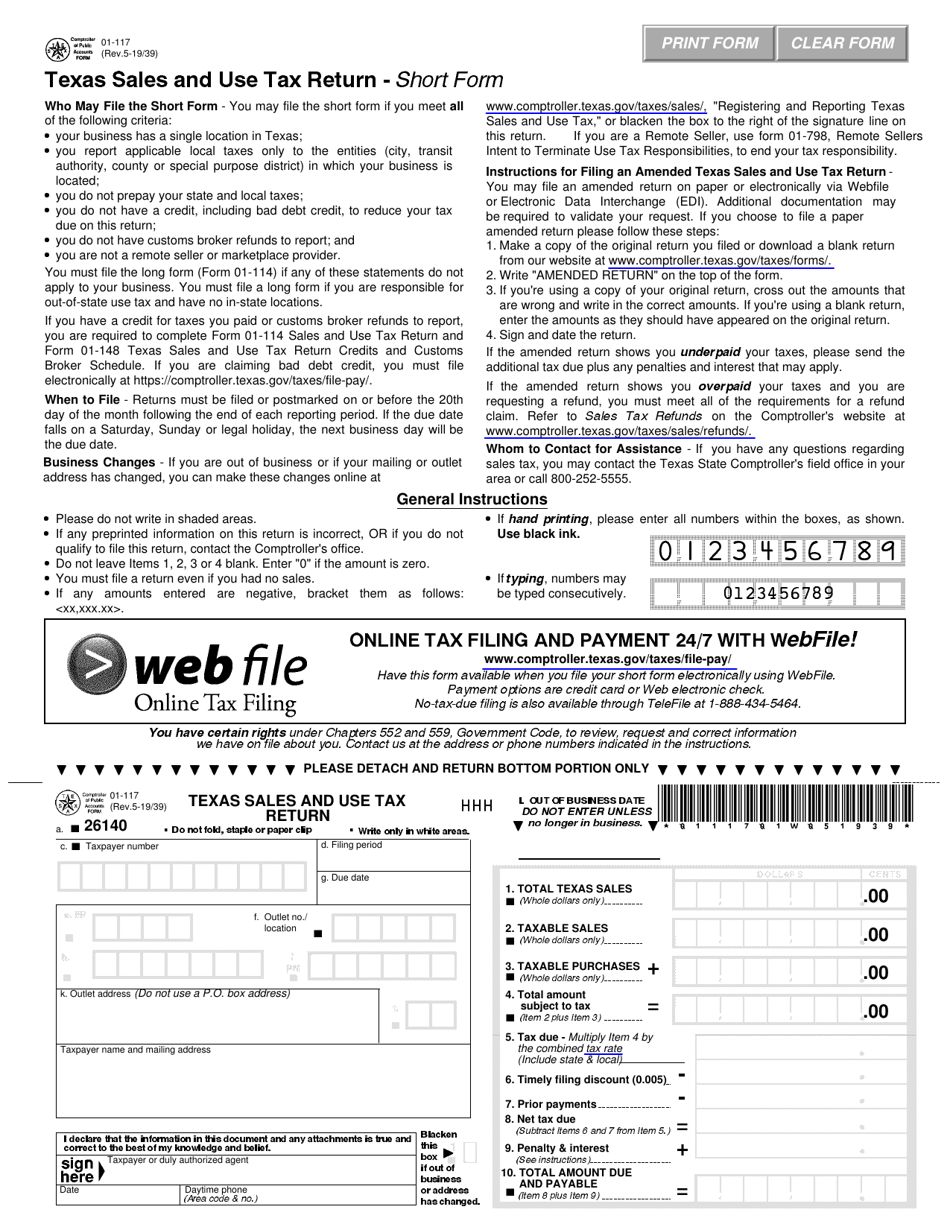

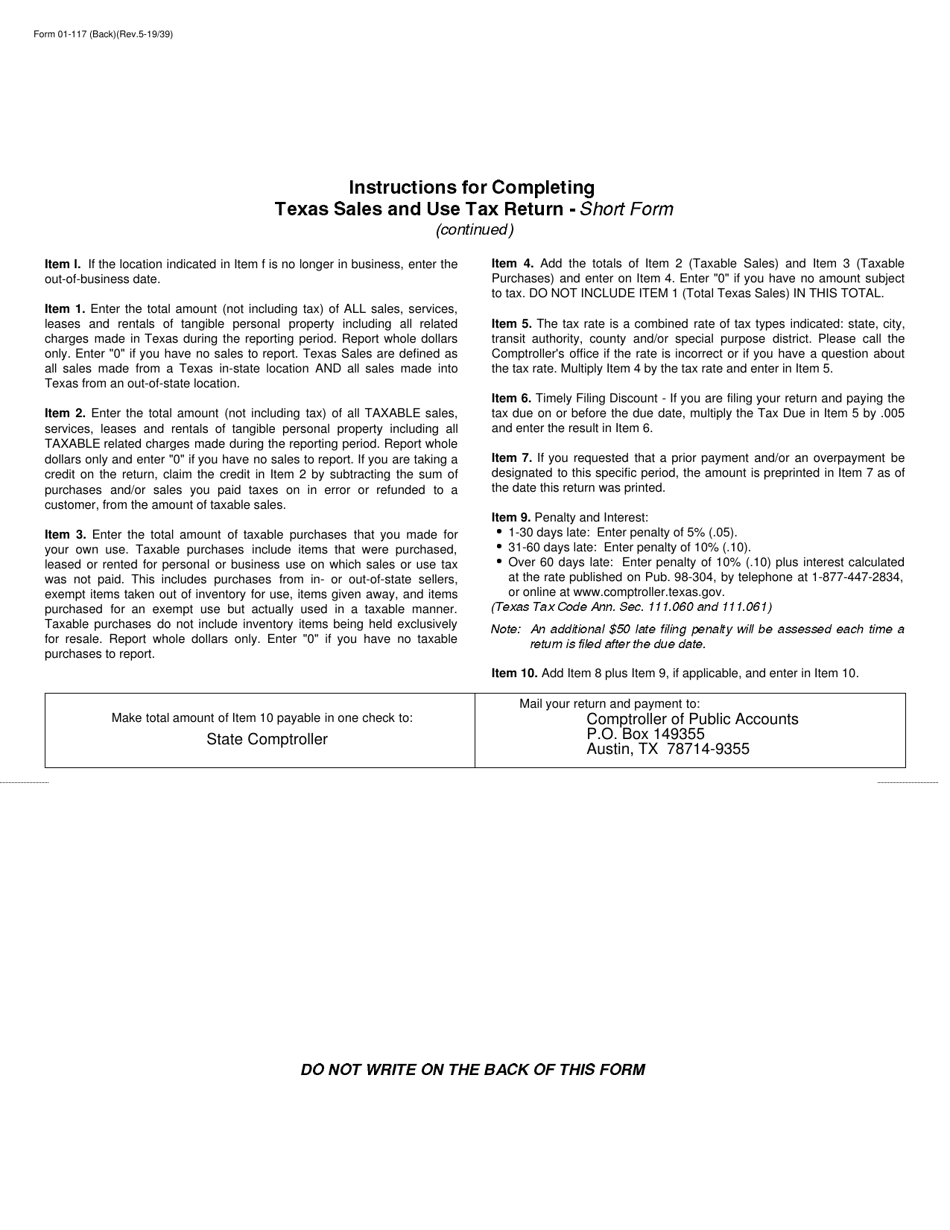

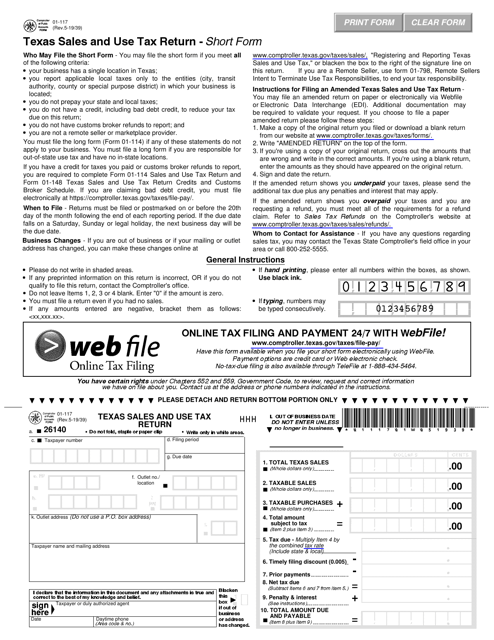

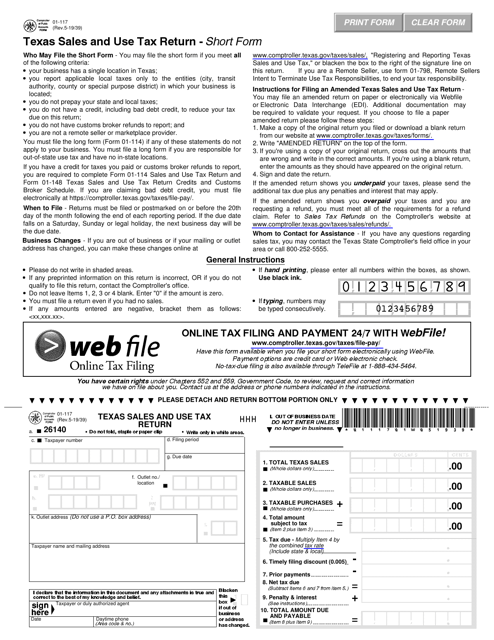

Form 01-117 Texas Sales and Use Tax Return - Short Form - Texas

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 01-117?

A: Form 01-117 is the Texas Sales and Use Tax Return - Short Form.

Q: What is the purpose of Form 01-117?

A: The purpose of Form 01-117 is to report and pay sales and use tax in Texas.

Q: Who needs to file Form 01-117?

A: Anyone who engages in taxable sales and purchases in Texas must file Form 01-117.

Q: What information is required on Form 01-117?

A: Form 01-117 requires information such as total sales, taxable sales, and tax due.

Q: When is Form 01-117 due?

A: Form 01-117 is due on the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing or non-payment?

A: Yes, there are penalties for late filing or non-payment, including interest charges and possible legal action.

ADVERTISEMENT

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-117 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.

Download Form 01-117 Texas Sales and Use Tax Return - Short Form - Texas

4.7 of 5 ( 29 votes )

1

2

Prev 1 2 Next

ADVERTISEMENT

Linked Topics

Use Tax Sales Tax Texas Comptroller of Public Accounts Tax Return Template Texas Legal Forms United States Legal Forms

Related Documents

- IRS Form 990-EZ Short Form Return of Organization Exempt From Income Tax, 2023

- Form 01-114 Texas Sales and Use Tax Return - Texas

- Form 01-148 Texas Sales and Use Tax Return Credits and Customs Broker Schedule - Texas

- Form 01-115 Texas Sales and Use Tax Return - Outlet Supplement - Texas

- IRS Form 4506T-EZ Short Form Request for Individual Tax Return Transcript

- IRS Form 4506-T-EZ Short Form Request for Individual Tax Return Transcript

- IRS Form 8038-GC Information Return for Small Tax-Exempt Governmental Bond Issues, Leases, and Installment Sales

- IRS Form 1120-FSC U.S. Income Tax Return of a Foreign Sales Corporation

- Form 14-312 Texas Motor Vehicle Sales Tax Exemption Certificate - for Vehicles Taken out of State - Texas

- Form 14-313 Texas Motor Vehicle Sales Tax Resale Certificate - Texas

- Form 67-104 Texas Mixed Beverage Sales Tax Report - Location Supplement - Texas

- Form 67-103 Texas Mixed Beverage Sales Tax Report - Texas

- Form 18-100 Texas Manufactured Housing Sales Tax Return - Texas

- Form 01-752 Continuous Bond of Seller (Sales Tax) - Texas

- Form 01-797 Worksheet for Completing the Sales and Use Tax Return Form 01-117 - Texas, 2023

- Form 01-790 Worksheet for Completing the Sales and Use Tax Return Forms 01-114, 01-115 and 01-116 - Texas, 2023

- Form 67-105 Continuous Bond - Mixed Beverage Sales Tax - Texas

- Form 14-117 Texas Motor Vehicle Seller-Financed Sales Tax and/or Surcharge Report - Texas

- Form 14-125 Texas Motor Vehicle Seller-Financed Sales Tax Surcharge Declared Estimate and Prepayment - Texas

- Form 14-118 Texas Motor Vehicle Seller-Financed Sales Tax Declared Estimate and Prepayment - Texas

- Convert Word to PDF

- Convert Excel to PDF

- Convert PNG to PDF

- Convert GIF to PDF

- Convert TIFF to PDF

- Convert PowerPoint to PDF

- Convert JPG to PDF

- Convert PDF to JPG

- Convert PDF to PNG

- Convert PDF to GIF

- Convert PDF to TIFF

- Split PDF

- Merge PDF

- Sign PDF

- Compress PDF

- Rearrange PDF Pages

- Make PDF Searchable

- About

- Help

- DMCA

- Privacy Policy

- Terms Of Service

- Contact Us

- All Topics

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

Notice

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.